Economic self-confidence in 2022 took a damaging. The international economy in 2022 was marked by war in Ukraine and an expensive healing from the pandemic. The subsequent supply chain and energy disturbances set off a bout of inflation which reserve banks have actually struggled to compete with since.

Rates of interest increased putting pressure on both the monetary and genuine economy. Customers needed to make tough options of where to cut expense and by just how much. The year was marked with continuous rumours of an economic crisis. For numerous, those rumours were a technicality as the trademarks of an economic downturn had actually currently embeded in.

When you operate in the computer game market throughout a financial slump, one concern typically emerges: is the computer game market “economic crisis evidence”? Analyzing this, one method to explore this is from the supply side. Let’s take a look at how the computer game market carried out in 2022 versus this background of difficult financial headwinds. 2 metrics will be checked out: leading line income (sales earnings) and running earnings (revenue). This might offer us some hints how the market will carry out in 2023 with a couple of more tailwinds behind it.

From a layperson’s perspective the basic viewpoint is that 2022 has actually not been a terrific year for computer game. Throughout the very first months of the year, it began strong with releases such as Elden Ring, Lego Star Wars: The Skywalker Saga, Horizon Forbidden West and Pokémon Legends: Arceus. These titles offered much better than the very first months of 2021 with releases such as Super Mario 3D World + Bowser’s Fury and Monster Hunter Rise.

It looked so appealing up until May, when brand-new AAA video game launches all however dried up till the fall. The drought of releases, integrated with the decrease in costs on brochure video games (the correction from the pandemic spike in sales) led lots of to hypothesize that 2022 was a bad year. It was a year for lots of in the market, and for players, they would rather ignore.

The remarkable thing is when evaluating the 2022 monetary declarations from the big computer game publishers, this sensation of passiveness was not substantiated by their numbers.

To include consistency to the examination:

- All financial declarations have actually been adapted to the seasonal calendar (January– December)

- Typical 2022 foreign exchange rates has actually been utilized for the Yen ( ¥ 132 to $1), the Euro (EUR1.054 to $1) and the Chinese CNY (元6.72 to $1).

- Tencent numbers just include their computer game incomes.

- Nintendo and Sony consist of earnings from hardware sales.

- The majority of the publishers will likewise consist of profits from mobile and other incomes which might not be straight computer game sales.

- It was not possible to get precise information on Microsoft Xbox financial resources.

Profits

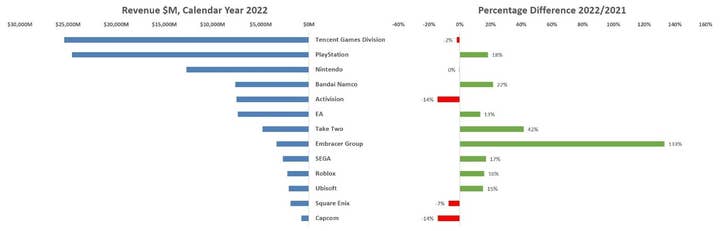

The chart listed below programs a two-year pattern for overall earnings for thirteen of the biggest publishers, omitting Microsoft.

The chart left wing reveals overall calendar 2022 earnings divulged by business. The chart on the best shows their particular portion year-on-year modification compared to calendar 2021.

8 of the thirteen publishers published a boost in profits for 2022 compared to 2021. When taking all thirteen publishers in overall, profits increased by 9%. That is an additional $8 billion invested by customers.

Income for the leading 13 publishers increased by 9%. That is an additional $8 billion invested by customers

The circumstance for some publishers had actually been beneficial due to the release of strong sales for their brand-new releases, while for others it was mostly due to the debt consolidation of their live service video games and DLC techniques. The Embracer Group more than doubled its earnings, assisted with the acquisitions of advancement homes Saber Interactive, DECA Games, Gearbox and Easybrain in the last 2 years.

Take- Two saw its earnings boost by 42% as it continued to see a growth of its “Recurrent Consumer Spending”. According to Take-Two financial Q3 2023 financials (calendar Q4 2022), 79% of overall income originated from repeating earnings (particularly microtransactions), a boost from the 61% contribution published a year earlier.

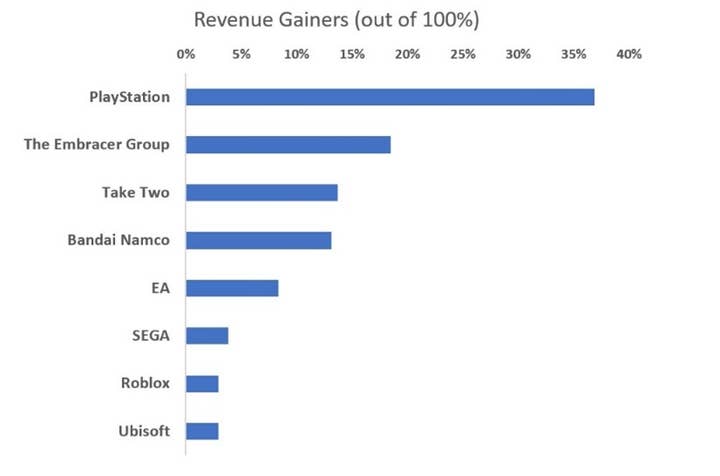

A few of these big portion boosts in profits revealed by the business can be rather misleading. Provided some business are smaller sized in earnings base than others, any boost in earnings would appear big by contrast. A clearer concept of which business contributed the most, by method of income boost, would be to compare those income increases among each other; this is discovered in the chart below.

More than one third of the contributing profits boost originated from Sony’s PlayStation department. This was nearly two times the contribution in income boost that originated from the Embracer Group (PlayStation increased profits by $3.8 billion to the Embracer Group’s $1.9 billion).

By contrast, income development, in dollar terms, from the Embracer Group was more than double that to EA, and EA was more than double that of Sega, Roblox or Ubisoft.

The takeaway from this photo analysis is that 2022 was not a bad year at all when taking a look at it through the viewpoint of these business P&L s. If one were to include all the boosts in earnings, integrated it would concern an additional $11 billion in costs compared to 2021.

The repeating story from their monetary disclosures is that where decreases did happen it was generally from brochure costs. New video game releases continued to reveal healthy numbers (such as God of War Ragnarök having the most significant launch in its franchise history, among others). The Gamesindustry.biz short article ‘Video video game sales avert strong financial headwinds, for the time being’ explores this phenomenon with higher information.

When these healthy brand-new video games sales are integrated with the development in live services microtransaction costs, indications are that the market has actually discovered a sustainable method for development, even throughout strong financial unpredictabilities. If 2022 saw more tentpole titles get launched, rather of being postponed to this year (and 2024), the gross position would probably be even healthier.

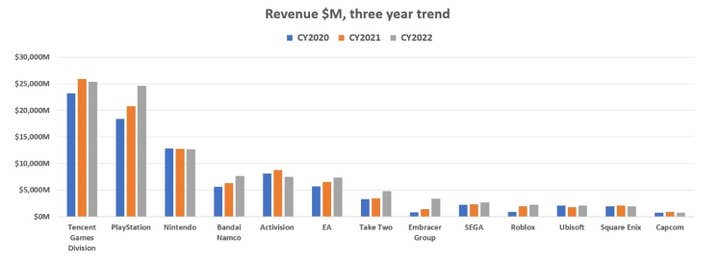

This photo of resistant development is most likely best seen from a three-year point of view. The chart listed below programs the overall profits for the 13 tracked publishers given that 2020.

The speed of profits development for some publishers has actually been remarkable. With the release of the PS5, Sony’s PlayStation department improved gross sales from $18.4 billion in 2020 to $24.6 billion. The PlayStation department now represents 30% of Sony’s overall earnings base, a boost of 3 portion points in the previous 2 years (information based upon Sony’s financial declaration 9 months ending December 2022). The PlayStation department is the greatest earner for the Sony company.

Over the last 3 years there corresponded development from Bandai Namco, EA, Take-Two, Embracer Group, Sega and Roblox Inc. The boost in profits for EA, Take-Two and Roblox were straight associated to increased customer costs on video games and game-related material. This can not be stated for the others.

Nintendo might have plateaued in earnings development, however it was still far the most successful publisher

While release of the Elden Ring, Sonic Frontiers and Saints Row assisted Bandai Namco, Sega and the Embracer Group respectively, computer game sales just form part of their income base and a few of the development originated from in other places. Fortunately is that even if profits development for publishers are not straight associated to video game sales, the bedrock for financial investment and the swimming pool of cash to take part in video game advancement exists.

Clearly not every publisher succeeded. Nintendo lost cash by a minimal quantity every year throughout the last 3 years, even with record breaking video games which launched in 2022 such as Pokémon Scarlet and Violet and Splatoon 3. The strong release for Modern Warfare 2 did not reverse the fortunes for Activision Blizzard which saw a $1.3 billion drop in costs in between 2021 and 2022 (practically two-thirds of the losses published amongst the 5 publishers which published a decrease in dollar sales originated from Activision Blizzard).

When including the year-on-year losses for the 5 publishers that experienced a decrease, customers invested $2.1 billion less than in 2022 than they carried out in 2021. That decrease was substantial, it was still a quarter compared to the boost in costs from the 8 publishers that published development. Development in leading line profits in 2022 more than balanced out decreases.

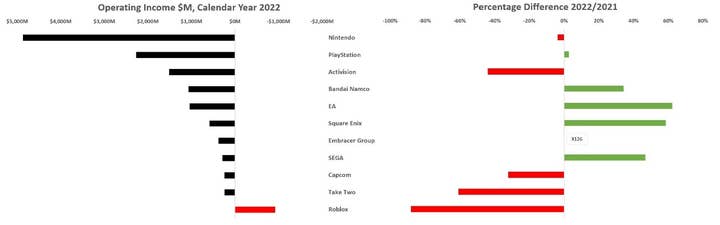

Running Income

A recession in income does not always spell an issue if the underlying financial scenario for a business is strong and this is substantiated when taking a look at the operating earnings. Nintendo might have plateaued in earnings development, however it was still far the most lucrative publisher, as laid out in the chart below.

Nintendo’s net position in 2022 reached $4.9 billion, more than two times that of Sony’s PlayStation department. Even those business that published decreases in the leading earnings such as Activision Blizzard and Square Enix stated a healthy revenue of $1.5 billion and $584 million respectively. The biggest turn-around in fortune was the Embracer Group which saw its net position of $3 million in 2021 boost to $380 million in 2022, a boost so big in portion terms it was off the charts.

The only business whose net position published a loss was Roblox Inc. Roblox has a set of scenarios which are distinct to its service, and which I will cover off in a future post. It ought to be kept in mind that Roblox net position is getting even worse by the year and although the business stated higher incomes with every year, it is likewise publishing higher losses.

The photo was not entirely rosy. Of the eleven business whose net position might be determined, earnings were down by $872 million, or 7%, in between 2021 and 2022. There were numerous contributing aspects to this, each distinct to the business worried, however in general, the increasing expenses in video game advancement is the common measure.

In Summary

When summing up the fiscal year 2022 leading line and fundamental profits numbers for the leading publishers in the computer game market the reading is among self-confidence.

Apart from the extra year-on-year 9% in costs, the net position for practically all the business was above absolutely no, revealing revenue. For the PlayStation department at Sony, Bandai Namco, EA, Embracer Group and Sega, they all stated a boost in sales and running earnings.

You can see 2022 was not all bad for the video game market.

Sam Naji is creator of computer game analytics and consultancy company SJN Insights