By Alex Kimani – Apr 01, 2023, 6:00 PM CDT

At a specific point in its lifecycle, every market faces its minute of considering growing pressure to change due to elements such as increasing competitors, altering customer choices, federal government policy and other nonreligious headwinds. The improvement generally takes the shape of enhanced supply chain discipline in addition to improving organization operations in order to accomplish much better operating margins.

For the oil and gas market, the decisive moment got here a couple of years earlier after years of weak criteria costs, diminishing margins and enormous capital flight required the sector to seriously reconsider the method it works with energy business significantly turning towards tech heavyweights for assistance in cutting expenses and simplifying operations.

An excellent case in point is a collaboration struck in betweenHaliburton Co.(NYSE: HAL),Microsoft Inc.(NASDAQ: MSFT )andAccenture Plc.(NYSE: ACN) in 2020. For many years, Haliburton, among the world’s biggest oilfield services business, has actually been afflicted by diminishing margins and persistent underperformance. The business ultimately negotiated with the 2 cloud giants to move its existing information centers to cloud and improve digital offerings.

Huge cost savings

Source: CNBC

Halliburton is barely alone.

After years of dilly-dallying, oil and gas business are now quickly moving their IT facilities out to the Cloud in addition to embracing Business Process Management (BPM) systems. This often leads to a leaner, more nimble organizational design whilst providing substantial expense savings.

Barclays approximates that the upstream market digital services market will grow from less than $5 billion in 2020 to a more than $30 billion yearly tab by 2025, therefore allowing $150 billion in yearly cost savings for oil manufacturers. Opportunities for expense savings consist of cutting capital investment (capex) in addition to selling, basic and administrative (SG&A) expenses and transport operating expense.

According to Barclays, the digital age is lastly dawning for the energy sector with the marketplace poised to emerge over the next 5 years. Over the previous couple of years, Microsoft has actually struck cloud collaborations with numerous Big Oil business consisting ofExxonMobil(NYSE: XOM),Chevron Inc(NYSE: CVX) and Haliburton while Google’s moms and dad businessAlphabet Inc.(NASDAQ: GOOG)has actually substantially broadened its collaboration withSchlumberger Ltd.(NYSE: SLB), another oilfield services giant.Amazon Inc.( NASDAQ: AMZN)uses digital services to the market through Amazon Web Services oil and gas department, and countsBP Plc(NYSE: BP) andShell Plc(NYSE: SHEL) amongst its leading customers.

Oftentimes, Big Oil’s digital remodeling is rather substantial.

Halliburton kicked off numerous digital change jobs throughout the pandemic. Thailand’s PTT Exploration and Production and Kuwait Oil Company were amongst the significant oil and gas business that were granted Halliburton agreements to execute digital change and improve effectiveness and production at their oilfields.

For many years, Big Oil has actually been utilizing tech business’ business software application in their extremely intricate os– consisting of rig management operations and accurate drilling strategies. They have actually generally been rather hesitant to hand over their treasure chests of important information primarily on cyber security issues as well as the requirement to preserve competitive benefits, choosing rather to establish many of their software application established internal or by business within the oilfield services sector such as Haliburton.

This is now altering as they look for methods to enhance functional performances in a quote to squeeze greater money circulations and earnings from their existing operations.

Is the brand-new method working? The proof appears to recommend so, with shale drilling expenses on a motivating drop.J.P. Morganquotes that Permian’s Delaware Basin oil drillers now need oil costs of simply ~$33/bbl to recover cost below $40/bbl in 2019.

Expert System (AI)

Let’s face it: Our electrical grids are just ill-suited for the energy shift. Sustainable power is extremely periodic by nature whereas our grids are developed for near-constant power input/output. Wind and solar energy have the least expensive capability elements of any energy source.

For the energy shift to be effective, our power grids need to end up being a lot smarter. Thankfully, there’s a motivating precedent.

5 years earlier,Googlerevealed that it had actually reached 100% renewable resource for its international operations including its information centers and workplaces. Today, Google is the biggest business purchaser of sustainable power, with dedications amounting to 2.6 gigawatts (2,600 megawatts) of wind and solar power.

In 2017, Google coordinated with IBM to look for an option to the extremely periodic nature of wind power. Utilizing IBM’s DeepMind AI platform, Google released ML algorithms to 700 megawatts of wind power capability in the main United States– sufficient to power a medium-sized city.

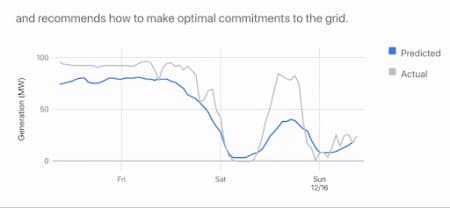

IBM states that by utilizing a neural network trained on commonly offered weather report and historic turbine information, DeepMind is now able to forecast wind power output 36 hours ahead of real generation. This has actually improved the worth of Google’s wind energy by approximately 20 percent.

A comparable design can be utilized by other wind farm operators to make smarter, much faster and more data-driven optimizations of their power output to much better satisfy consumer need.

IBM’s DeepMind utilizes experienced neural networks to forecast wind power output 36 hours ahead of real generation

Source: DeepMind

Houston, Texas-based Innowatts, is a start-up that has actually established an automatic toolkit for energy tracking and management. The business’s eUtility platform consumes information from more than 34 million wise energy meters throughout 21 million consumers consisting of significant U.S. energy business such as Arizona Public Service Electric, Portland General Electric, Avangrid, Gexa Energy, WGL, and Mega Energy. Innowatts states its maker finding out algorithms have the ability to evaluate the information to anticipate numerous important information points consisting of brief- and long-lasting loads, differences, weather condition level of sensitivity, and more. Innowatts price quotes that without its maker discovering designs, energies would have seen errors of 20% or more on their forecasts at the peak of the crisis therefore positioning huge pressure on their operations and eventually increasing expenses for end-users.

Even more, AI and digital options can be used to make our grids safer.Three years back, California’s greatest energy, Pacific Gas & & Electric, discovered itself in deep difficulty after being discovered culpable for the awful 2018 wildfire mishap that left 84 individuals dead and, as a result, was slapped with large charges of $13.5 billion as settlement to individuals who lost houses and companies and another $2 billion fine by the California Public Utilities Commission for carelessness. Maybe the death and income might have been avoided if PG&E had actually purchased some AI-powered early detection system like Innowats.By utilizing digital and AI designs, our power grids will end up being significantly smarter and more reputable and make the shift to renewable resource smoother.

Blockchain

Regardless of its massive capacity to change the international energy sector, blockchain innovation has actually mainly stayed restricted to the monetary sector with the energy market regularly catalyzed by developments in sub-sectors such as roof solar, overseas wind, clever metering, battery storage, and electrical cars.

This is now starting to alter thanks to the Enterprise Ethereum blockchain emerging as the most recent innovation to stimulate development in the energy sector throughout a raft of verticals from peer-to-peer (P2P) energy trading and clever agreements to green energy provenance and systems interoperability.

A Global Blockchain in Energy Market research study file states blockchain innovation in the energy market is about to tape-record explosive development over the next 5 years with blockchain energy start-ups such asPower Ledger, WePower, UAB,andLO3 Energyset to open brand-new possibilities for the energy market, varying from cost-savings for the customer by getting rid of 3rd parties in energy offers and faster deal settlements, all the method to the development of a brand-new market for peer-to-peer and excess renewable resource trading.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Climb As Iraq’s Dispute With Kurdistan Escalates

- PetroChina Sees Chinese Fuel Demand Rising By 3% From Pre-Covid Levels

- Mercedes Signs Deal With Spanish Renewables Giant

Download The Free Oilprice App Today

Back to homepage

![]()

Alex Kimani

Alex Kimani is a veteran financing author, financier, engineer and scientist for Safehaven.com.

More Info

Associated posts

Leave a remark