Megacap technology stocks have dominated the performance of the American stock market this year, driving the Nasdaq Composite to a new nine-month high today as investors piled into them as a “safe-haven play” in response to concerns about a potential economic crisis, a breach of the federal debt ceiling, and increased tension in local banks.

The top 100 non-financial companies listed on the Nasdaq exchange are tracked by the tech-focused Nasdaq-100 index, NDX, +0.52% which closed at its highest level since April 2022 on Thursday. According to FactSet Data, the index rose 3.5% today, and it has really gained more than 26% so far this year.

The weekly gain for the Nasdaq Composite COMP, +0.51% was over 3%. According to FactSet Data, the tech-heavy gauge has really gone up by 20.9% as of this writing in 2023. That contrasts with a mere 0.8% increase for the Dow Jones Industrial Average DJIA, -0.33% and a 9.2% year-over-year gain for the more comprehensive S&P 500 index SPX, +0.09%

In fact, shares of American IT behemoths have held up well until this point in 2023. According to data from Bloomberg provided to MarketWatch, Apple Inc. AAPL, -0.66% stock has really grown about 35% this year, pushing its market valuation past that of the entire Russell 2000 RUT, +0.58% for two weeks, the longest stretch ever. According to FactSet Data, Meta Platforms Inc. META, +2.96% has increased 104.1% year to date while Alphabet Inc. GOOGL, +2.72%, the parent company of Google, has increased 39.1%.

See: Apple is now worth more than the entire Russell 2000, signalling a turning point in the stock market.

In order to understand what factors have truly made innovation stocks the dominant force in the U.S. equities market in 2023, as well as any potential drawbacks, MarketWatch spoke with experts.

A reversion of the 2022 trades

After the bear market of 2022, investors were very cautious and had low expectations for the tech sector going into 2023. According to John Porter, chief financial investment officer and head of equity at Newton Investment Management, this was “a great starting point for a group to exceed when there are doubters that provide you with an opportunity to show them incorrect.”

The Nasdaq Composite fell by over 33% in 2022 as a result of the high growth potential of the index’s tech-heavy stocks, which made them particularly vulnerable to the rise in interest rates designed by the Federal Reserve to combat inflation.

According to Mike Dickson, head of research study and product expansion at Horizon Investments, “They’re thought of as development stocks, and people want to pay a greater evaluation as they’re anticipated to grow.” “Looking backwards on a year-over-year basis, they really haven’t been growing, but from an expectation standpoint, it does appear that today is probably the bottom for profits unless we get really poor development potential customers moving forward,” the author said.

Strong balance sheet and long lasting profits streams

Given their rock-solid balance sheets, excellent cash flow production, and healthy revenue margins, Megacap leads from this past quarterly revenues reporting season seem to be viewed as confirmation that the sector may continue to produce significant development.

Olivier d’Assier, head of APAC used research study at Qontigo, said in a phone interview on Friday that “they are big business with well-diversified earnings bases, without any financial obligation, with rewarding earnings declarations, and with strong balance sheets.” “Even if they [investors] are placing their bets on technology, they are doing it in the conservative and secure sector of the industry. Megatech are able to withstand a storm.

Porter claimed to have observed a new era of “expense discipline” at certain well-known tech companies. In comparison to other types of equities, their balance sheets and earnings streams are more alluring to financiers because of their management of expenses, which is translated into faster-than-expected revenue growth, according to Porter.

According to John Butters, senior revenue analyst at FactSet, 78% of the 95% of S&P 500 companies that announced results for the first quarter of 2023 recorded a favourable earnings-per-share surprise, exceeding the 5-year average of 77%.

A possible end to Fed rate walkings

According to market experts, signs that US inflation is starting to slow down and the Federal Reserve’s rate-hiking cycle is about to come to a close also contributed to the tech management.

On Friday, Fed Chair Jerome Powell said his colleagues thought it would take some time to get inflation back to the reserve bank’s 2% target, confirming that the Fed hasn’t made up its mind about what to do at its June 13–14 FOMC conference. Lorie Logan, president of the Dallas Federal Reserve, said on Thursday that the information available so far does not support delaying a rate hike until June.

dealers in Fed-funds futures According to the CME FedWatch tool, the probability of a further quarter-point rate hike by the reserve bank in June was 16.8% on Friday.

Huge Tech’s AI trend

Nevertheless, Porter told MarketWatch in a phone interview on Friday that the most significant driver of megacap tech’s outperformance over the past six to eight weeks has actually been expert system (AI).

We’re in an AI hype cycle, which has given many important equities in the tech industry a halo, which has been kind of the cherry on top, according to Porter.

Since investors have flocked to Nvidia Corp. NVDA, +0.16% this year, the chip maker’s stock is expected to increase by 113.9% by the end of 2023. The founder and president of Nvidia, Jensen Huang, forecasted that income from platforms for artificial intelligence would increase significantly over the course of the following year as businesses either embraced AI or abandoned it.

According to FactSet Data, Microsoft Corp. MSFT, +0.74% has seen its stock climb by 32.7% this year, while AI service provider C3.ai AI, +5.93% has witnessed a 125.9% decline during the same time period.

According to David Russell, vice president of market intelligence at TradeStation, there is a very good chance that investors are witnessing a “considerable boom of AI revenues and development.” “We have new products and services, which means higher margins and better prices. We’re entering a period in which e-commerce, cloud computing, and cloud migration are losing ground to artificial intelligence (AI).

AI is a “child bubble,” according to Bank of America, but in the interim, a Fed “error” might burst it.

Is megacap tech miscalculated?

In late April, even a company like Microsoft was trading at a price-to-earnings ratio of 33, which “appears a little expensive to us for a business that isn’t even growing its revenues by one third of its several,” wrote Michael Landsberg, chief financial investment officer at Landsberg Bennett Private Wealth Management.

“Paying too much for little development does not delight us,” he said. “We do not mind spending for development.”

With Apple, Microsoft, Amazon.com AMZN, -0.15% NVIDIA, and Alphabet now making up more than 20% of the large-cap index, big tech continues to have a significant weighting in the S&P 500 index. According to BMO Capital Market strategists lead by Brian G. Belski, main financial investment strategist, the current aggregate weight reflects a notable increase from the 17% at the beginning of the year and is gradually beginning to approach the record level of 22.3% embedded in 2020.

As a result, many investors have grown extremely concerned about the potential effects that this top-heavy concentration might have on market performance, particularly if big names begin to falter, Belski wrote in a note on Thursday.

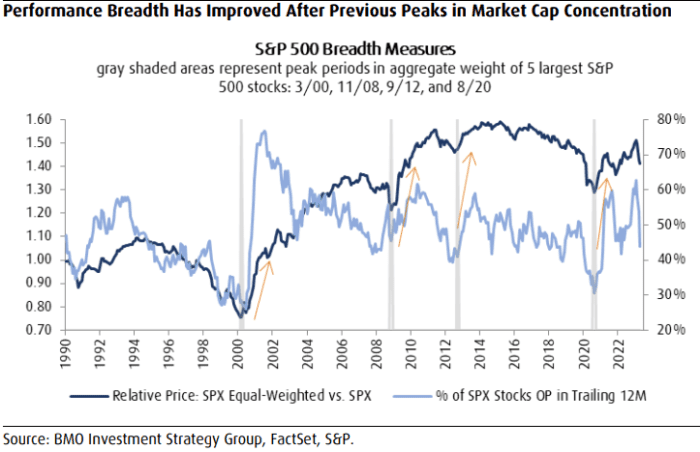

Belski and his team acknowledge that intense concentration isn’t always bad for productivity. The increase in the percentage of outperforming stocks and upward trends in the relative rate of the S&P 500 Equal-Weighted index SP500EW, +0.06% show in the chart below that efficiency breadth tends to rise in the six and twelve months following market cap concentration peaks.

Efficiency breadth often indicates the diversity of increasing stocks in relation to declining stocks in a specific stock index. When there are more rising stocks than falling stocks, the market breadth increases.

SOURCE: BMO INVESTMENT STRATEGY GROUP, FACTSET, S&P

See:

The tech sector dominates the S&P 500. This means that future stock market returns will be as follows.

The persistent megacap tech rally does not rule out the possibility of a reversal in the future, but market analysts have cautioned that these stocks’ greatest strengths may also be their worst drawbacks.

The debt-ceiling agreements in Congress and the unpredictabilities surrounding the Fed’s aggressive financial tightening up cycle, according to Porter of Newton Investment Management, “are likely more macro than micro per se,” and “the most significant short-term danger is most likely more macro than micro per se.”

“Let’s imagine for a moment that cooler heads prevail and Washington realises that, despite your politics, they must put their own private programmes on hold in order to act in the country’s best interests. Ideally, that [agreement on the debt ceiling] will happen, but if it doesn’t, that might cause volatility, according to Porter.

“We’ll probably need to keep an eye on the trends and financial data in order to address this debt ceiling in the future… And if we can work some of that out, I think the rest of the market can join [the surge],” Dickson of Horizon Investments told MarketWatch over the phone.

U.S. stocks finished the week little higher, with the S&P 500 gaining 1.7% and the Dow Industrials gaining 0.4%.